Using these smart tax savings strategies will help you get off to a good start and may help you save more money.

Check Your W-4

This year, you may have started a new job, new marital status or family member. If you are expecting changes in income or the number of people in your family, you should double check and change the amount of withholding from your paycheck so you don’t have too much or too little withheld. You can use the IRS Withholding Calculator to help you fill out the form.

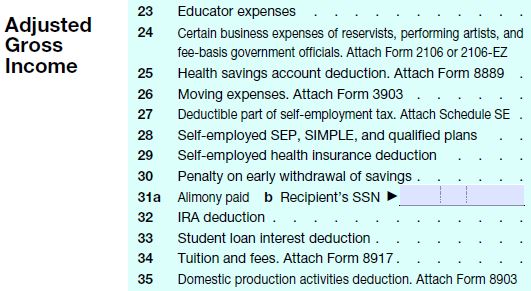

Lower Your Taxable Income

Taking above-the-line tax deductions – such as moving expenses for a job, the tuition and fees deduction, health savings account contributions, traditional IRA contributions, and the educator expense deduction – can all reduce your taxable income which is your adjusted gross income and save you money at tax time. Also, if you purchased health insurance in the health insurance marketplace and received a premium tax credit, you may get an even bigger premium tax credit when you file your taxes if your taxable income is lower than expected.

Open or Maximize Your IRA

If you have an IRA account or are contemplating opening one, you can contribute up to $5,500 ($6,500 if you are 50 and over) to your IRA until the tax deadline and still reap the benefit of a deduction on your 2016 taxes. If you have low to moderate income, you may also be eligible for the saver’s credit up to $1,000 ($2,000 for a married couple).

Open or Maximize Your HSA

Health savings accounts (HSA) are designed for people with high-deductible healthcare plans. If you have a HSA from your employer or contemplating opening one, below are the amounts for 2016:

- HSA holders can choose to save up to $3,350 for an individual and $6,750 for a family (HSA holders 55 and older get to save an extra $1,000 which means $4,350 for an individual and $7,750 for a family) – and these contributions are 100% tax deductible from gross income.

- Minimum annual deductibles are $1,300 for self-only coverage or $2,600 for family coverage.

- Annual out-of-pocket expenses (deductibles, copayments, and other amounts, but not premiums) cannot exceed $6,550 for self-only coverage and $13,100 for family coverage

Start Contributing or Maximize Your Retirement Account

If you have an employer provided retirement account, now is a good time to think about starting to contribute or maximizing your contributions. For 2016, you can contribute up to $18,000 ($6,000 if you are age 50 and over) in 401(k) and 403(b) plans. Even if you can’t max out your retirement account, you may want to increase the amount you are contributing. You would be surprised how easy it is to get used to an increased salary deferral coming out of your paycheck when it’s building your nest egg and helping your tax situation.

Take Deductions for Capital Losses

If you have capital gains on your investments, you can take any capital losses against those gains and pay no tax on your positive investment returns. Even if you have no capital gains from investments, you can still take up to $3,000 of capital losses against your ordinary income.

Make Estimated Tax Payments

Did you dive into the world of self-employment this year? Sure, working from the comfort of your home in your pajamas can be a luxury, but you may be subject to estimated taxes. Generally, the self-employed or anyone who expects to owe $1,000 or more is expected to pay quarterly estimated tax payments.

Deduct Job-related Auto Expenses and/or Charitable Mileage

If you itemize deductions, when you use your automobile at your employer’s request to run job assignments and your employer does not reimburse you, you may deduct the standard mileage rate. If you are reimbursed less than that rate, you can deduct the difference. If you have a second job, the mileage between the two jobs is also deductible.

You can also take deductions related to charitable gifts and volunteer work. You can deduct travel expenses incurred by traveling to charitable organizations for meetings, fundraisers, or other events. You can deduct parking and toll fees, as well as bus, taxi, and other travel fares that are involved in doing your charitable work.

Make Sure You Have Medical Insurance

Not having health insurance can add to your income taxes owed. Per the Affordable Care Act (AKA Obamacare), every person must have health insurance unless they qualify for an exemption or other circumstances stated in the law. You do not get an exemption for being unemployed but may qualify for a hardship exemption. The penalty for not having health insurance for 2016 is 2.5% of household income or $695 per person.

Remember What You Did Last Year

Big life events such as getting married or having a baby are easy to remember, but our lives are busy and some little expenses that can add up to bigger deductions may be forgotten. Don’t forget to have receipts in hand for expenses related to your job search, day camp for the kids, charitable donations and medical expenses, to name a few, when you sit down to file your taxes. These expenses may help you get a bigger tax refund.

Organize Your Tax Documents

Gather your documents, forms and receipts for tax-deductible expenses in one place throughout the year so you don’t forget anything. Keep a folder next to where you place mail. That way, when W-2s, 1099s and other relevant forms roll in, you can keep them together in an accessible spot so you’re ready to go when you sit down to file your taxes.

Other Tax Saving Ideas

- Start a Business and deduct qualified expenses

- Deduct sales tax from buying a car (must itemize deductions and amount has to be more than state income taxes)

- Deduct personal property taxes based only on the value of personal property such as a boat or car (must itemize deductions)

- Don’t forget about tax credits you qualify for; child tax credit, earned income tax credit, child and dependent care expenses, adoption expenses, energy credits

- Don’t withdrawal money or take loans from your retirement account; this adds to your taxable income and 10% tax penalty.

- Other Itemized deductions