If you make a work-related move, you may be able to deduct the costs of the move. This may apply if you move to start a new job or to work at the same job in a new job location.

Tag: taxes

IRS Launches Site to Explain Affordable Care Act

The IRS has launched a new Affordable Care Act Tax Provisions website at IRS.gov/aca to educate individuals and businesses on how the health care law may affect them. The home page has three sections, which explains the tax benefits and

Tax Tips for Taxpayers Who Travel for Charity Work

Do you plan to travel while doing charity work this summer? Some travel expenses may help lower your taxes if you itemize deductions when you file next year. Here are five tax tips the IRS wants you to know about

Tax Tips if You’re Starting a Business

If you plan to start a new business, or you’ve just opened your doors, it is important for you to know your federal tax responsibilities. Here are five basic tips from the IRS that can help you get started. Type

IRS Gives Tax Relief To Oklahoma Tornado Victims

Return Filing and Tax Payment Deadlines Extended to Sept. 30, 2013 WASHINGTON –– After the devastating tornado in Moore and Oklahoma City, the Internal Revenue Service has provided tax relief to individuals and businesses affected by this and other severe storms

Tax Tips – Summer Job Tax Information for Students

When summer vacation begins, classroom learning ends for most students. Even so, summer doesn’t have to mean a complete break from learning. Students starting summer jobs have the opportunity to learn some important life lessons. Summer jobs offer students the

Tax Tips – Dealing with IRS Notices

Each year, the IRS sends millions of letters and notices to taxpayers for a variety of reasons. Here are ten things you should know about IRS notices in case one shows up in your mailbox. Don’t panic. Many of these

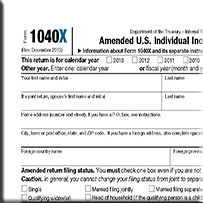

Tax Tips – Filing an Amended Tax Return

Ten Facts on Filing an Amended Tax Return What should you do if you already filed your federal tax return and then discover a mistake? Don’t worry; you have a chance to fix errors by filing an amended tax return.

IRS Payment Options

Ten Helpful Tips for Paying Your Taxes Do you owe the IRS this year? If so, here are 10 important things the IRS wants you to know about correctly paying your federal income taxes. Never send cash. If you file

April 15 Tax Tasks

You know Monday, April 15, is tax day. The big job you must complete by this deadline is finishing and filing your 2012 tax return or Form 4868, which will give you an extension until Oct. 15 to file your