When summer vacation begins, classroom learning ends for most students. Even so, summer doesn’t have to mean a complete break from learning. Students starting summer jobs have the opportunity to learn some important life lessons. Summer jobs offer students the

Tag: tax tips

Tax Tips – Six Facts on Tax Refunds and Offsets

Certain financial debts from your past may affect your current federal tax refund. The law allows the use of part or all of your federal tax refund to pay other federal or state debts that you owe. Here are six

Tax Tips – Dealing with IRS Notices

Each year, the IRS sends millions of letters and notices to taxpayers for a variety of reasons. Here are ten things you should know about IRS notices in case one shows up in your mailbox. Don’t panic. Many of these

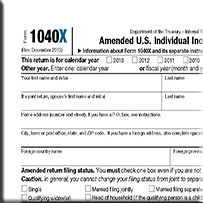

Tax Tips – Filing an Amended Tax Return

Ten Facts on Filing an Amended Tax Return What should you do if you already filed your federal tax return and then discover a mistake? Don’t worry; you have a chance to fix errors by filing an amended tax return.

Tax Tips – Eight Facts on Late Filing and Penalties

April 15 is the annual deadline for most people to file their federal income tax return and pay any taxes they owe. By law, the IRS may assess penalties to taxpayers for both failing to file a tax return and

Paying Business Expenses from Personal Accounts

It happens to the best of us. If you have more than one credit card, you may use the wrong one. You’re at a business meeting at a restaurant and you pay with your personal credit card, or you pay

Six Tips on Making Estimated Tax Payments

Some taxpayers may need to make estimated tax payments during the year. The type of income you receive determines whether you must pay estimated taxes. Here are six tips from the IRS about making estimated tax payments. If you do

Avoid Common Errors – Last Minute Filers

IRS Tax Tip WASHINGTON, D.C. — The Internal Revenue Service reminded taxpayers to review their tax returns for common errors that could delay the processing of their returns. Here are some ways to avoid common mistakes. File electronically. Filing electronically, whether

Six Tax Tips for Self-Employed

When you are self-employed, it typically means you work for yourself, as an independent contractor, or own your own business. Here are six key points the IRS would like you to know about self-employment and self-employment taxes: Self-employment income can