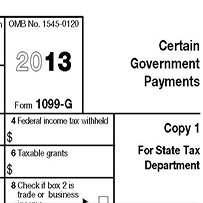

Residents of Connecticut, Missouri, New Jersey, New York and Pennsylvania (and possibly other states) will no longer receive a mailed copy of Form 1099-G, Certain

Tag: tax news

No Tax Refunds During Shutdown

Tax Refunds In other government shutdown news, the IRS announced on its website on Tuesday that, “Tax refunds will not be issued until normal government operations resume.”

IRS Provides Tax Relief to Victims of Colorado Storms

The Internal Revenue Service is providing tax relief to individual and business taxpayers impacted by severe storms, flooding, landslides and mudslides in Colorado. The IRS

Tax Tips if You’re Starting a Business

If you plan to start a new business, or you’ve just opened your doors, it is important for you to know your federal tax responsibilities.

IRS Gives Tax Relief To Oklahoma Tornado Victims

Return Filing and Tax Payment Deadlines Extended to Sept. 30, 2013 WASHINGTON –– After the devastating tornado in Moore and Oklahoma City, the Internal Revenue Service

IRS Swamped

The Internal Revenue Service said Tuesday that its Modernized e-File Prouction system is taking longer to generate federal acknowledgments for tax return filings. The IRS