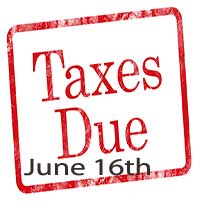

If you are self-employed or have other third-quarter income that requires you to pay quarterly estimated taxes, make sure your third quarter payment is postmarked by Sept. 16, 2014. What are the filing dates for federal quarterly estimated tax payments?

Tag: payments

2nd Quarter 2014 Estimated Taxes Due June 16

Tips on Making Estimated Tax Payments If you don’t have taxes withheld from your pay, or you don’t have enough tax withheld, then you may need to make estimated tax payments. If you’re self-employed you normally have to pay your

Alternatives to Calling the IRS Next Week

IRS Warns of Heavy Call Volume, Offers Tips for Faster Answers WASHINGTON – The IRS reminded taxpayers the Presidents Day holiday period typically marks one of the busiest weeks of the tax filing season for its phone lines. There are

Tax Tips – Eight Facts on Late Filing and Penalties

April 15 is the annual deadline for most people to file their federal income tax return and pay any taxes they owe. By law, the IRS may assess penalties to taxpayers for both failing to file a tax return and

IRS Payment Options

Ten Helpful Tips for Paying Your Taxes Do you owe the IRS this year? If so, here are 10 important things the IRS wants you to know about correctly paying your federal income taxes. Never send cash. If you file