The New (and improved?) Form 1040 The new Form 1040 has been touted as a simple way for most people to file their income taxes on a page the size of a postcard. Is that really the case? Depending on

Tag: irs

Tax Relief for Victims of Hurricane Michael

Extended filing and payment deadlines Hurricane Michael victims in parts of Florida and elsewhere have until Feb. 28, 2019, to file certain individual and business tax returns and make certain tax payments. The tax relief postpones various tax filing and

Meals and Entertainment Expenses per TCJA Tax Reform

The IRS has issued Notice 2018-76, that provides guidance on the business expense deduction for meals and entertainment. This is in light of the Tax Cuts and Jobs Act (TCJA), which was supposed to eliminate deductions for expenses pertaining to

California SB 274 – Administration of Taxes: Notice of Deficiency Assessment

SB 274 Governor Brown signed SB 274, which generally conforms to the new federal centralized partnership audit regime. The new regime allows the IRS to conduct audits, make adjustments and assessments, and collect tax at the partnership level (rather than

AB 2503 Lets California FTB Dissolve Inactive Companies

Governor Signs AB 2503 Governor Brown has signed AB 2503, which makes a domestic corporation and a limited liability company subject to voluntary or involuntary administrative dissolution or administrative cancellation if:

Extended Individual Tax Returns Due October 15, 2018 and Other Tax Deadlines

Taxpayers who requested an extra six months to file their 2017 tax return, Monday, October 15, 2018, is the extension deadline for most taxpayers. This is also the last day to e-file a 2017 Federal Income Tax Return electronically – paper returns

State and Local Income Taxes (SALT) and Charitable Contributions

IR-2018-172 Treasury, IRS issue proposed regulations on charitable contributions and state and local tax credits WASHINGTON — The U.S. Department of the Treasury and the Internal Revenue Service issued proposed regulations providing rules on the availability of charitable contribution deductions

2018 Taxes Affected by TCJA 2017 Tax Reform

Tax Reform 101 The Tax Cuts and Jobs Act of 2017 officially starts affecting tax returns Jan 1, 2018, so your taxes next January will look a bit (or a lot) different. Let’s walk through some of the most significant

August 2018 Tax Newsletter

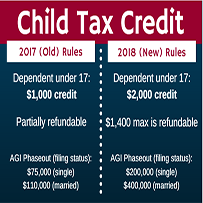

Tax Notes The Tax Cuts and Jobs Act raised the Child Tax Credit from $1,000 to $2,000. Of this, up to $1,400 can be a refundable credit. The Internal Revenue Service has not fully explained how this will work, but I’ll

July 2018 Tax Newsletter

Mid-Year Tax Checkup It’s hard to believe that we are halfway through the year already. July is a good time to make sure that you are making the best choices for your tax health. Here are some tips to help