IRS Tax Tip WASHINGTON, D.C. — The Internal Revenue Service reminded taxpayers to review their tax returns for common errors that could delay the processing of their returns. Here are some ways to avoid common mistakes. File electronically. Filing electronically, whether

Tag: irs

Health Insurance Deduction for Self-Employed

Don’t Miss the Health Insurance Deduction if You’re Self-Employed If you are self-employed, the IRS wants you to know about a tax deduction generally available to people who are self-employed. The deduction is for medical, dental or long-term care insurance

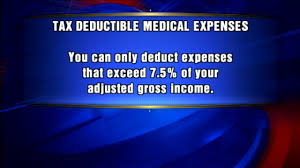

Maximize Medical Deductions

Medical costs seem to increase every year. There is a way to get Uncle Sam to foot some of the doctor bills, but you need to make sure you know and follow the rules. The Internal Revenue Service lets you

Free Copy of Tax Return Transcript

Your Tax Return or Tax Account Transcript can be Ordered Online for Free A transcript is acceptable as a substitute for a copy of a previously filed tax return in many situations. The IRS offers two types of transcripts: Tax

IRS Swamped

The Internal Revenue Service said Tuesday that its Modernized e-File Prouction system is taking longer to generate federal acknowledgments for tax return filings. The IRS said the situation “may continue throughout the remainder of the day as receipts increase” of

Report 2010 Roth Conversions on 2012 Returns

IRS Reminds Taxpayers to Report 2010 Roth Conversions on 2012 Returns IR-2013-21, Feb. 19, 2013 WASHINGTON — The Internal Revenue Service reminds taxpayers who converted amounts to a Roth IRA or designated Roth account in 2010 that in most cases

10 Facts About Mortgage Debt Forgiveness

Canceled debt is normally taxable to you, but there are exceptions. One of those exceptions is when the debt is partly or entirely forgiven during 2007 through 2012. Here are 10 facts about mortgage debt forgiveness: Normally, debt forgiveness results

Alimony and Taxes

When the end of matrimony leads to the start of alimony, each parting partner can feel the tax effects. If you are the ex-spouse getting alimony payments, the money is taxable to you as income in the year it is received. This

Deducting Mortgage Points

If you have ever taken out a mortgage, you probably already know of the tax advantage provided by deducting your mortgage interest payments. But many homeowners overlook another tax break available for points paid to get a home loan. In some cases,

Determining Your Correct Filing Status

It’s important to use the correct filing status when filing your income tax return. It can impact the tax benefits you receive, the amount of your standard deduction and the amount of taxes you pay. It may even impact whether