Do you plan to travel while doing charity work this summer? Some travel expenses may help lower your taxes if you itemize deductions when you file next year. Here are five tax tips the IRS wants you to know about

Tag: irs

Tax Tips if You’re Starting a Business

If you plan to start a new business, or you’ve just opened your doors, it is important for you to know your federal tax responsibilities. Here are five basic tips from the IRS that can help you get started. Type

IRS Gives Tax Relief To Oklahoma Tornado Victims

Return Filing and Tax Payment Deadlines Extended to Sept. 30, 2013 WASHINGTON –– After the devastating tornado in Moore and Oklahoma City, the Internal Revenue Service has provided tax relief to individuals and businesses affected by this and other severe storms

Tax Tips – Six Facts on Tax Refunds and Offsets

Certain financial debts from your past may affect your current federal tax refund. The law allows the use of part or all of your federal tax refund to pay other federal or state debts that you owe. Here are six

Tax Tips – Dealing with IRS Notices

Each year, the IRS sends millions of letters and notices to taxpayers for a variety of reasons. Here are ten things you should know about IRS notices in case one shows up in your mailbox. Don’t panic. Many of these

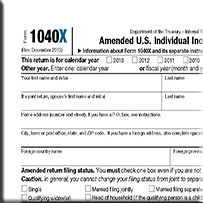

Tax Tips – Filing an Amended Tax Return

Ten Facts on Filing an Amended Tax Return What should you do if you already filed your federal tax return and then discover a mistake? Don’t worry; you have a chance to fix errors by filing an amended tax return.

IRS Gives Boston Taxpayers 3-Month Extension

TACCT extends our thoughts and prayers to all who have been affected by the events that occurred at the Boston Marathon. The Internal Revenue Service granted a three-month tax filing and payment extension to Boston-area taxpayers and others affected by

Tax Tips – Eight Facts on Late Filing and Penalties

April 15 is the annual deadline for most people to file their federal income tax return and pay any taxes they owe. By law, the IRS may assess penalties to taxpayers for both failing to file a tax return and

IRS Payment Options

Ten Helpful Tips for Paying Your Taxes Do you owe the IRS this year? If so, here are 10 important things the IRS wants you to know about correctly paying your federal income taxes. Never send cash. If you file

April 15 Tax Tasks

You know Monday, April 15, is tax day. The big job you must complete by this deadline is finishing and filing your 2012 tax return or Form 4868, which will give you an extension until Oct. 15 to file your