Tax Reform 101 The Tax Cuts and Jobs Act of 2017 officially starts affecting tax returns Jan 1, 2018, so your taxes next January will

Tag: gambling

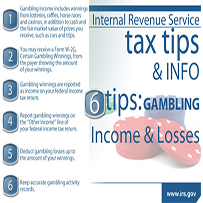

Tax Tips – Gambling Income and Losses

Six Tips on Gambling Income and Losses Whether you roll the dice, play cards or bet on the ponies, all your winnings are taxable. The