Taxpayers who requested an extra six months to file their 2017 tax return, Monday, October 15, 2018, is the extension deadline for most taxpayers. This is also the last day to e-file a 2017 Federal Income Tax Return electronically – paper returns

Tag: extensions

September 2018 Tax Newsletter

Tax Notes If you own a pass-through entity such as a partnership, S corporation, LLC or sole proprietorship, look for information soon about the Qualified Business Income Deduction. Proposed regulations were released on August 8. Below is some info.

August 2018 Tax Newsletter

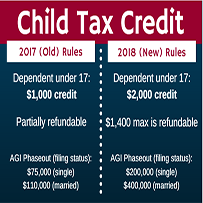

Tax Notes The Tax Cuts and Jobs Act raised the Child Tax Credit from $1,000 to $2,000. Of this, up to $1,400 can be a refundable credit. The Internal Revenue Service has not fully explained how this will work, but I’ll

March 15 Filing Deadline for Partnerships and S Corp Returns

The filing deadline for calendar year partnerships and S corporations is March 15, 2017. These returns must be filed (e-filed or postmarked) by midnight (local time) on March 15, 2017. Fiscal year returns will be due the 15th day of the

Important Dates Coming Up

Deadlines for Tax Filing Individual Returns Individuals that opted for an extension is October 17th, 2016