One key to success in starting a new business is to know about your federal tax obligations such as income taxes and payroll taxes. Below

Tag: expenses

Tax Tips – Gambling Income and Losses

Six Tips on Gambling Income and Losses Whether you roll the dice, play cards or bet on the ponies, all your winnings are taxable. The

Paying Business Expenses from Personal Accounts

It happens to the best of us. If you have more than one credit card, you may use the wrong one. You’re at a business

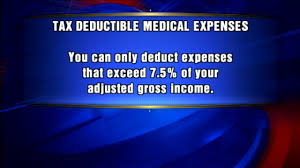

Employee Business Expenses

Employees often give a little extra in their jobs. If that giving is literal, you paid some work-related costs and weren’t reimbursed, so you may be