Going to college can be a stressful time for students and parents. The IRS offers these tips about education tax benefits that can help offset some college costs and maybe relieve some of that stress. American Opportunity Tax Credit. This

Tag: deductions

Tax Tips – Gambling Income and Losses

Six Tips on Gambling Income and Losses Whether you roll the dice, play cards or bet on the ponies, all your winnings are taxable. The IRS offers these six tax tips for the casual gambler. Gambling income includes winnings from

Tax Tips – Special Tax Benefits for Armed Forces Personnel

If you’re a member of the U.S. Armed Forces, the IRS wants you to know about the many tax benefits that may apply to you. Special tax rules apply to military members on active duty, including those serving in combat

Tax Tips for Taxpayers Who Travel for Charity Work

Do you plan to travel while doing charity work this summer? Some travel expenses may help lower your taxes if you itemize deductions when you file next year. Here are five tax tips the IRS wants you to know about

Health Insurance Deduction for Self-Employed

Don’t Miss the Health Insurance Deduction if You’re Self-Employed If you are self-employed, the IRS wants you to know about a tax deduction generally available to people who are self-employed. The deduction is for medical, dental or long-term care insurance

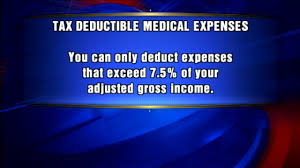

Maximize Medical Deductions

Medical costs seem to increase every year. There is a way to get Uncle Sam to foot some of the doctor bills, but you need to make sure you know and follow the rules. The Internal Revenue Service lets you

College Tax Benefits for 2012 and Years Ahead

Parents and Students: Check Out College Tax Benefits for 2012 and Years Ahead IR-2013-22, Feb. 22, 2013 WASHINGTON — The Internal Revenue Service today reminded parents and students that now is a good time to see if they qualify for

Alimony and Taxes

When the end of matrimony leads to the start of alimony, each parting partner can feel the tax effects. If you are the ex-spouse getting alimony payments, the money is taxable to you as income in the year it is received. This

Deducting Mortgage Points

If you have ever taken out a mortgage, you probably already know of the tax advantage provided by deducting your mortgage interest payments. But many homeowners overlook another tax break available for points paid to get a home loan. In some cases,

2012 Standard and Itemized Deductions

Most taxpayers claim the standard deduction amount. The amounts are adjusted each tax year for inflation. For 2012, the standard deduction for taxpayers younger than 65