Exciting news for home based food businesses with the passage of AB-626 by Governor Brown in September. The new law has now made it permissible to sell food cooked from your home effective January 1, 2019, of course there are

Tag: california

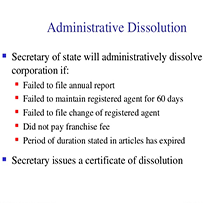

AB 2503 Lets California FTB Dissolve Inactive Companies

Governor Signs AB 2503 Governor Brown has signed AB 2503, which makes a domestic corporation and a limited liability company subject to voluntary or involuntary administrative dissolution or administrative cancellation if:

SOS to Dissolve Qualified Inactive California Nonprofit Corporations

Nonprofit Administrative Dissolution Beginning January 2017, we will move forward to administratively dissolve qualified inactive nonprofit corporations. Assembly Bill 557 (Stats. 2015, ch. 363), which becomes effective January 1, 2017, provides for the administrative dissolution of qualified inactive nonprofit corporations.

California Head of Household Filing

New FTB Form 3532 Starting this year, 2015 tax return, the California Franchise Tax Board is requiring form FTB 3532, Head of Household Filing Status Schedule to be completed and attached to the tax return if you claim the status.

California Earned Income Tax Credit (EITC)

Governor Brown recently signed into law the state’s first ever EITC to help California’s poorest working families. The California EITC complements the federal EITC by providing a refundable tax credit for the lowest income California households. The credit will be