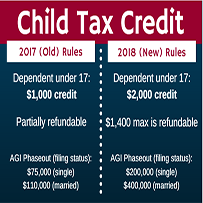

Tax Notes The Tax Cuts and Jobs Act raised the Child Tax Credit from $1,000 to $2,000. Of this, up to $1,400 can be a refundable credit. The Internal Revenue Service has not fully explained how this will work, but I’ll

Tag: 1040x

Three Popular Tax Benefits Retroactively Renewed for 2017; IRS Ready to Accept Returns

The IRS announced on February 22 that its processing systems have been reprogrammed to handle the three benefits most likely to be claimed on returns filed early in the tax season. These benefits have been renewed as part of the Bipartisan Budget Act, enacted on February 9. As a result, you

Missing a W2 Form?

What to Do if You’re Missing a W2 Most people get their W-2 forms by the end of January. Form W-2, Wage and Tax Statement, shows your income and the taxes withheld from your pay for the year. You need

Filing an Amended Tax Return

IRS Summertime Tax Tip 2016-02 You may discover you made a mistake on your tax return. You can file an amended return if you need to fix an error. You can also amend your tax return to claim a tax

Tax Tips – Filing an Amended Tax Return

Ten Facts on Filing an Amended Tax Return What should you do if you already filed your federal tax return and then discover a mistake? Don’t worry; you have a chance to fix errors by filing an amended tax return.