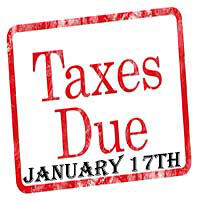

Why Pay Estimated Tax To avoid interest and penalties, you must make sufficient federal and state income tax payments long before your April filing deadline

Tag: 1040-es

April 15 Tax Tasks

You know Monday, April 15, is tax day. The big job you must complete by this deadline is finishing and filing your 2012 tax return