Nonprofit Administrative Dissolution

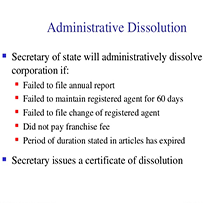

Beginning January 2017, we will move forward to administratively dissolve qualified inactive nonprofit corporations.

Assembly Bill 557 (Stats. 2015, ch. 363), which becomes effective January 1, 2017, provides for the administrative dissolution of qualified inactive nonprofit corporations.

Who is affected?

Qualified nonprofit corporations that are suspended or forfeited by us for a period of 48 continuous months or more and are no longer in business.

What will be done?

We will mail a contact letter to selected nonprofit corporations informing them of the pending administrative dissolution to the last known valid mailing address. A list of the selected corporations pending administrative dissolution will be posted on the California Secretary of State (SOS) website. If a corporation does not have a known valid mailing address, notification will only occur by the posting on the SOS website.

Corporations will have 60 days to object in writing to the pending administrative dissolution.

What happens if the corporation objects?

If the corporation objects in writing during the 60 day notice period, then it will have 90 days from the date of the written notice to pay any owed taxes, penalties, and interest and file any missing returns and a current Statement of Information with SOS, or it will be administratively dissolved/surrendered at the end of the 90 day period. (We are authorized to grant one 90 day extension.)

Additional information will be made available on our Charities and Nonprofits webpage to provide guidance to nonprofit corporations on the administrative dissolution process as procedures are developed.

For more information about tax requirements and/or applying for tax-exempt status, visit ftb.ca.gov and search for Charities, or contact our Exempt Organizations Unit at 916.845.4171, 7 a.m. to 4:30 p.m. weekdays, except state holidays.

Follow us: @the_tax_lady | TACCT on Facebook

Refer-a-Friend and get paid! Your referral is the highest compliment you can give us.

Read our February 2017 Tax Insight Newsletter (pdf)