Taxpayers often have questions about Individual Retirement Arrangements, or IRAs. Common questions include: When can a person contribute, how does an IRA impact taxes, and what are other common rules. The IRS offers the following tax tips on IRAs:

Tax Tips – Uber, Lyft, and Other Ride-Share Drivers

Ride-Sharing Services Instead of sitting at home watching TV reruns during their down time, some of people are making extra cash by offering their services in the shared economy. One of the most popular methods is to become a driver for

March 15 Filing Deadline for Partnerships and S Corp Returns

The filing deadline for calendar year partnerships and S corporations is March 15, 2017. These returns must be filed (e-filed or postmarked) by midnight (local time) on March 15, 2017. Fiscal year returns will be due the 15th day of the

Need a Tax Transcript or IP PIN

At this time of the year, some tax payers are seeking their Identity Protection PINs or are in need of a tax transcript. For inquiries about IP PIN and transcripts, use the online service options on IRS.gov:

Missing a W2 Form?

What to Do if You’re Missing a W2 Most people get their W-2 forms by the end of January. Form W-2, Wage and Tax Statement, shows your income and the taxes withheld from your pay for the year. You need

What Deduction Should You Take – Itemized or Standard?

Itemize or Choose the Standard Deduction Most taxpayers claim the standard deduction when they file their federal tax return. However, some filers may be able to lower their tax bill by itemizing. Find out which way saves the most money

Where’s My Refund – Contacting the IRS about Refunds for Held Up Returns

Where’s My Refund for Held Up Tax Returns “Where’s My Refund?” will be updated on Feb. 18 for the vast majority of early filers who claimed the Earned Income Tax Credit or the Additional Child Tax Credit. Before Feb. 18,

February Challenge – Tax Filing Time!

Get Your Taxes Done in 3 Simple Steps We all know filing taxes isn’t fun for most of us. That’s why TACCT Taxes is here to provide your tax preparation needs. It’s not complicated to get prepared for your tax

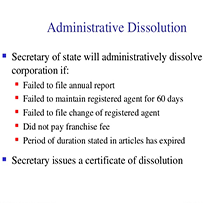

SOS to Dissolve Qualified Inactive California Nonprofit Corporations

Nonprofit Administrative Dissolution Beginning January 2017, we will move forward to administratively dissolve qualified inactive nonprofit corporations. Assembly Bill 557 (Stats. 2015, ch. 363), which becomes effective January 1, 2017, provides for the administrative dissolution of qualified inactive nonprofit corporations.

Tax Documents You’ll Need to File Your Tax Return

Tax Documents Due Date By law, employers have until January 31st (or the next business day if it’s a weekend or holiday) to send you their annual tax statements such as W2s, 1099-INT etc. Many taxpayers have opted to receive