Five Things to Know if You Need More Time to File IRS Tax Tip 2013-52, April 10, 2013 The April 15 tax-filing deadline is fast

Tax/Business News & Updates

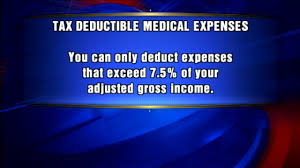

Maximize Medical Deductions

Medical costs seem to increase every year. There is a way to get Uncle Sam to foot some of the doctor bills, but you need

Six Tax Tips for Self-Employed

When you are self-employed, it typically means you work for yourself, as an independent contractor, or own your own business. Here are six key points

Free Copy of Tax Return Transcript

Your Tax Return or Tax Account Transcript can be Ordered Online for Free A transcript is acceptable as a substitute for a copy of a

Employee Business Expenses

Employees often give a little extra in their jobs. If that giving is literal, you paid some work-related costs and weren’t reimbursed, so you may be

IRS Swamped

The Internal Revenue Service said Tuesday that its Modernized e-File Prouction system is taking longer to generate federal acknowledgments for tax return filings. The IRS

College Tax Benefits for 2012 and Years Ahead

Parents and Students: Check Out College Tax Benefits for 2012 and Years Ahead IR-2013-22, Feb. 22, 2013 WASHINGTON — The Internal Revenue Service today reminded

Report 2010 Roth Conversions on 2012 Returns

IRS Reminds Taxpayers to Report 2010 Roth Conversions on 2012 Returns IR-2013-21, Feb. 19, 2013 WASHINGTON — The Internal Revenue Service reminds taxpayers who converted

10 Facts About Mortgage Debt Forgiveness

Canceled debt is normally taxable to you, but there are exceptions. One of those exceptions is when the debt is partly or entirely forgiven during

Alimony and Taxes

When the end of matrimony leads to the start of alimony, each parting partner can feel the tax effects. If you are the ex-spouse getting alimony