Making your January 2015 mortgage payment in December 2014 can help increase your mortgage interest deduction which in turn can lower your taxable income. When your taxable income is lower then your total tax is lowered and can increase your

Tax/Business News & Updates

Required Minimum Distributions for 2014

Are you a retiree who is 70 1/2 years old and have a traditional Individual Retirement Arrangement (IRA) or work retirement account 401(k), 403(b) and 457(b). Remember to take your required minimum distribution (RMD) by December 31, 2014. Special Rule

Free Web Tools for Businesses

As a business owner, when running your own business, it’s important to use every resource at your disposal especially free ones. These tools will help your business with its online presence. The 10 free Web Tools below should make your

Year-End Gifts to Charity

The Internal Revenue Service reminds individuals and businesses making year-end gifts to charity that several important tax law provisions have taken effect in recent years. Some of the changes taxpayers should keep in mind include: Rules for Charitable Contributions of

Affordable Care Act Video by IRS Commissioner

Affordable Care Act: IRS Commissioner Explains What to Expect at Tax Time IRS Commissioner John Koskinen explains in this YouTube video how the Affordable Care Act will affect you this upcoming tax season. Watch this and other IRS videos on the

2014 Year End Tax Planning

Year-end Tax Planning Tips from the National Society of Accountants Current individual income tax rates of 10, 15, 25, 28, 33, 35 and 39.6 percent will be in place for 2015, as will current tax treatment of capital gains and

Apply for 2015 Health Coverage

The Healthcare.gov Marketplace open enrollment for 2015 starts November 15, 2014. Get ready to apply for affordable care act (ACA) insurance now: Check your state for plans and prices Apply and Enroll for health coverage – Starts Nov. 15, 2014

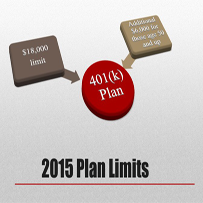

2015 Retirement Plan Contribution Limits

The Internal Revenue Service announced cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2015. Many of the pension plan limitations will change for 2015 because the increase in the cost-of-living index met the

Avoid Surprises at Tax-Time

Even though only a few months remain in 2014, you still have time to act so you aren’t surprised at tax-time next year. You should take steps now to avoid owing more taxes or getting a larger refund than you

Tax Filing Reminder – October 15, 2014

October 15, 2014 is the last day to efile a 2013 Federal Income Tax Return. If you requested a Federal tax-filing extension, you will need to submit your return to the IRS by Wednesday, October 15th. More Information at tacct.net