Filing small business taxes is an important process for every business, although it’s enjoyable to very few. In fact, some flat-out dread it. The problem is that some business owners think of taxes only in the weeks leading up to the

Tax/Business News & Updates

Filing an Extension for Business Taxes

March 15th is the deadline to file taxes for Corporations and S-Corporations and April 15th is the deadline for Partnerships, LLCs, and Sole Proprietorships. If you don’t think you can get your business taxes done by the deadline, you will

IRS “Dirty Dozen” Tax Scams for 2015

2015 Dirty Dozen WASHINGTON — The Internal Revenue Service wrapped up the 2015 “Dirty Dozen” list of tax scams with a warning to taxpayers about aggressive telephone scams continuing coast-to-coast during the early weeks of this year’s filing season. The

Book Drive Promotion for February and March

TACCT is in partnership with Crystal Bowl Book Club and is having a book drive promotion from Feb 17 – March 31. Donate two new or gently used children’s books and receive $5 off tax preparation fees. *You can also

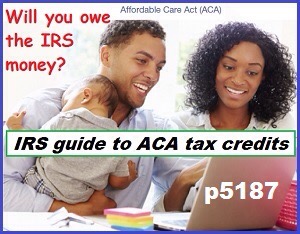

February 15th is the Deadline to Enroll at Healthcare.gov

Get Insured – 2015 Open Enrollment Ends 2/15/15 Marketplace open enrollment for 2015 is Nov 15, 2014 to Feb 15, 2015 Penalty Most people must have health coverage or pay a penalty. If you don’t have coverage, you’ll pay a penalty

Penalty Relief for the Repayment of the Advanced Premium Tax Credit

The IRS recently issued Notice 2015-9, providing limited penalty relief for qualified tax returns which have a repayment of the advanced premium tax credit. Generally, taxpayers who do not pay their entire tax liability by the return due date would

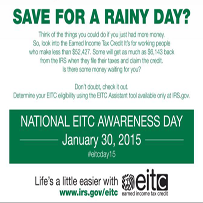

EITC Awareness Day 2015

Today is National Earned Income Tax Credit (EITC) Awareness Day for 2015. Four out of five workers claim and get the EITC they earned. In California alone, statistics for the 2013 tax year included 3.1 million EITC claims for a total

Health Coverage Exemption Certificate Number (ECN)

For a taxpayer that did not have health insurance for 2014, he or she must either owe a penalty tax on line 61 of Form 1040, or must file Form 8965, Health Coverage Exemptions, to report to the IRS why

Newly Married and Wondering How to Do Your Taxes

Congratulations! This exciting time in your life can bring lots of changes, such as moving into a new apartment, buying a house, combining finances or joining families. It’s so fun to start out your new life together, but it’s a

IRS Cutbacks and What it Means for You this Tax Season

With a couple of days to go before tax season opens, taxpayers were already bracing for a potentially “miserable” filing season. It turns out that it could live up to the hype. Internal Revenue Service (IRS) Commissioner Koskinen has advised