Tax Tips for the Self-Employed Prior to tax planning, you must understand the difference between a self-employed individual and one who works full-time. You should also know that self-employed professionals do not get taxes deducted from their pay.

Category: Tax Tips

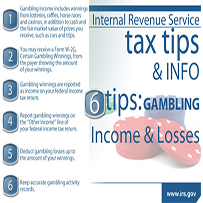

How to Report Gambling Income and Losses on Your Tax Return

Six Tips on Gambling Income and Losses Whether you roll the dice, play cards or bet on the ponies, all your winnings are taxable. The IRS offers these six tax tips for the casual gambler.

Adjusting Your Income Tax Withholdings to Receive More Money During the Year

Change Withholding Check your year-to-date withholding and consider changing the taxes withheld if you are expecting a large refund. This is especially important if you are claiming the earned income tax credit, or EITC, or the additional child tax credit. Why?

Explaining the Health Care Law and How it Affects You

Health Care Law If/Then Chart As you prepare to file your 2016 tax return, review this chart to see how the health care law affects you.

4 Tax Tips for upcoming Tax Season

Tax Tips Get ready for the 2017 tax season with these four simple tips.

Health Care Coverage Qualification

It’s Not Too Early to Determine Whether You Have Qualifying Health Care Coverage The individual shared responsibility provision requires you and each member of your family to have basic health coverage – also known as minimum essential coverage – qualify

Filing an Amended Tax Return

IRS Summertime Tax Tip 2016-02 You may discover you made a mistake on your tax return. You can file an amended return if you need to fix an error. You can also amend your tax return to claim a tax

Tax Saving Strategies

Using these smart tax savings strategies will help you get off to a good start and may help you save more money. Check Your W-4 This year, you may have started a new job, new marital status or family member.

Exempt Organizations Filing Deadline is today May 16th

When to File May 16, 2016 is the filing deadline for many exempt organizations. The IRS cautions taxpayers and professionals to not include Social Security Numbers or other unneeded personal information on Form 990.

IRS Tax Scams – Don’t Be A Victim

Don’t Fall for New Tax Scam Tricks by IRS Posers Though the tax season is over, tax scammers work year-round. The IRS advises you to stay alert to protect yourself against new ways criminals pose as the IRS to trick