Get Insured – 2015 Open Enrollment Ends 2/15/15 Marketplace open enrollment for 2015 is Nov 15, 2014 to Feb 15, 2015 Penalty Most people must have health coverage or pay a penalty. If you don’t have coverage, you’ll pay a penalty

Category: Tax News

Penalty Relief for the Repayment of the Advanced Premium Tax Credit

The IRS recently issued Notice 2015-9, providing limited penalty relief for qualified tax returns which have a repayment of the advanced premium tax credit. Generally, taxpayers who do not pay their entire tax liability by the return due date would

Health Coverage Exemption Certificate Number (ECN)

For a taxpayer that did not have health insurance for 2014, he or she must either owe a penalty tax on line 61 of Form 1040, or must file Form 8965, Health Coverage Exemptions, to report to the IRS why

IRS Cutbacks and What it Means for You this Tax Season

With a couple of days to go before tax season opens, taxpayers were already bracing for a potentially “miserable” filing season. It turns out that it could live up to the hype. Internal Revenue Service (IRS) Commissioner Koskinen has advised

Tax Season Starts January 20th 2015

The Internal Revenue Service announced that it anticipates opening the 2015 tax filing season as scheduled on January 20th 2015. Keep in mind, even if you want to file on January 20, you might not be ready. Employers have until the

Five Ways to Spot IRS Scam Phone Calls

The IRS has issued a consumer alert providing taxpayers with additional tips to protect themselves from telephone scam artists calling and pretending to be with the IRS. These callers may demand money or may say the taxpayer has a refund due and try to

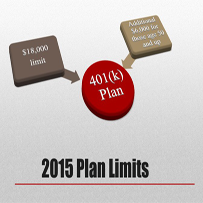

2015 Retirement Plan Contribution Limits

The Internal Revenue Service announced cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2015. Many of the pension plan limitations will change for 2015 because the increase in the cost-of-living index met the

Moved? Notify the Insurance Marketplace

Moving Can Affect Your Premium Tax Credit If you moved recently, you’ve probably notified the U.S. Postal Service, utility companies, financial institutions and employers of your new address. If you get health insurance coverage through a Health Insurance Marketplace, the

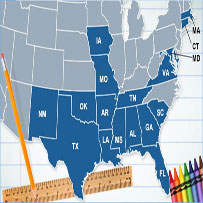

Back-to-School Sales Tax Holidays

Some call state sales-tax holidays gimmicks that rely on bad tax policy and cost states much-needed money. Others say the tax-free shopping days boost local economies by getting more people into stores where their purchases might go beyond untaxed goods. But

2014 Small Business Week

Do you own or run a business? If so, do you know the IRS offers special tax help just for you? For example, the IRS will host two free live webinars to mark National Small Business Week, May 12 –