The April 15, 2015 deadline for 2015 First Quarter estimated tax payments is approaching. Estimated tax is the method used to pay tax on income that is not subject to withholding. This includes income from self-employment, interest, dividends, alimony, rent, gains

Category: Tax Forms

Interactive Tax Assistant (ITA)

The Interactive Tax Assistant (ITA) is an online resource that can answer a wide range of tax questions, including newer areas of the tax law, like the Affordable Care Act. The ITA tool takes you through a series of questions and

Tax Tips – Employee Business Expenses

Five Tips You Should Know about Employee Business Expenses If you paid for work-related expenses out of your own pocket, you may be able to deduct those costs. In most cases, you claim allowable expenses on Schedule A, Itemized Deductions. Here

Filing an Extension for Business Taxes

March 15th is the deadline to file taxes for Corporations and S-Corporations and April 15th is the deadline for Partnerships, LLCs, and Sole Proprietorships. If you don’t think you can get your business taxes done by the deadline, you will

Health Insurance Information You Will Need to Prepare Your Taxes

Whether you are preparing your taxes yourself or using a tax preparer, this year’s taxes will be a little more complicated. Since the provisions of the Affordable Care Act (ACA) became effective in 2014, tax preparers need even more information

Tax Recordkeeping Tips

Resources Recordkeeping for Tax Purposes Guide (pdf) Small Business Recordkeeping Publication 583, Starting a Business and Keeping Records Basic records are documents that everybody should keep. Although the Internal Revenue Service (IRS) doesn’t require you to keep your records in

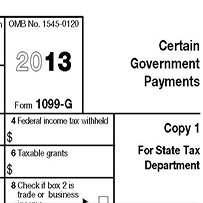

1099-G Online Form Requests

Residents of Connecticut, Missouri, New Jersey, New York and Pennsylvania (and possibly other states) will no longer receive a mailed copy of Form 1099-G, Certain Government Payments, for state and local income tax refunds. These states now require the taxpayer

Tax Tips – Gambling Income and Losses

Six Tips on Gambling Income and Losses Whether you roll the dice, play cards or bet on the ponies, all your winnings are taxable. The IRS offers these six tax tips for the casual gambler. Gambling income includes winnings from

Need More Time to File?

Five Things to Know if You Need More Time to File IRS Tax Tip 2013-52, April 10, 2013 The April 15 tax-filing deadline is fast approaching. Some taxpayers may find that they need more time to file their tax returns.

Free Copy of Tax Return Transcript

Your Tax Return or Tax Account Transcript can be Ordered Online for Free A transcript is acceptable as a substitute for a copy of a previously filed tax return in many situations. The IRS offers two types of transcripts: Tax