Change Withholding Check your year-to-date withholding and consider changing the taxes withheld if you are expecting a large refund. This is especially important if you are claiming the earned income tax credit, or EITC, or the additional child tax credit. Why?

Category: Tax Filing

Delayed Refunds for Tax Year 2016 Due to IRS Identity Theft Precautions

Refunds for Returns with EITC or ACTC Delayed The PATH Act of 2015 requires the IRS to hold 2016 refunds claiming the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC) until February 15. The IRS must hold

2017 Mileage Rates Lowered by IRS

The Internal Revenue Service has issued the 2017 optional standard mileage rates to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Beginning Jan. 1, standard mileage rates for the use of a car

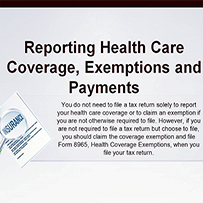

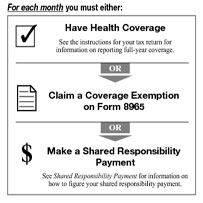

Determine if You’re Eligible for a Health Care Exemption or Have to Pay a Shared Responsibility Payment

Health Coverage Options With the 2017 tax filing season approaching, it’s not too early to think about how the health care law affects your taxes. The Affordable Care Act requires you and each member of your family to do at

2017 Tax Season

Tax Season Start Date The IRS announced that the 2017 tax season begins on January 23, but taxpayers claiming the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC) for 2016 will not have their refund issued…..

4 Tax Tips for upcoming Tax Season

Tax Tips Get ready for the 2017 tax season with these four simple tips.

Important Dates Coming Up

Deadlines for Tax Filing Individual Returns Individuals that opted for an extension is October 17th, 2016

Health Care Coverage Qualification

It’s Not Too Early to Determine Whether You Have Qualifying Health Care Coverage The individual shared responsibility provision requires you and each member of your family to have basic health coverage – also known as minimum essential coverage – qualify

Filing an Amended Tax Return

IRS Summertime Tax Tip 2016-02 You may discover you made a mistake on your tax return. You can file an amended return if you need to fix an error. You can also amend your tax return to claim a tax

Exempt Organizations Filing Deadline is today May 16th

When to File May 16, 2016 is the filing deadline for many exempt organizations. The IRS cautions taxpayers and professionals to not include Social Security Numbers or other unneeded personal information on Form 990.