The Internal Revenue Service announced plans to open the 2014 filing season on January 31 for all 1040 filers filing their 2013 income tax return. This includes all small business owners that file on Schedule C as sole proprietors, Schedule F as Farmers, or Schedule

Category: Tax Filing

No Tax Refunds During Shutdown

Tax Refunds In other government shutdown news, the IRS announced on its website on Tuesday that, “Tax refunds will not be issued until normal government operations resume.” This marked a change from its shutdown contingency plan, under which 859 employees in its

IRS Provides Tax Relief to Victims of Colorado Storms

The Internal Revenue Service is providing tax relief to individual and business taxpayers impacted by severe storms, flooding, landslides and mudslides in Colorado. The IRS announced today that certain taxpayers in the counties of Adams, Boulder, Larimer and Weld will

Tax Tips – Special Tax Benefits for Armed Forces Personnel

If you’re a member of the U.S. Armed Forces, the IRS wants you to know about the many tax benefits that may apply to you. Special tax rules apply to military members on active duty, including those serving in combat

IRS Gives Tax Relief To Oklahoma Tornado Victims

Return Filing and Tax Payment Deadlines Extended to Sept. 30, 2013 WASHINGTON –– After the devastating tornado in Moore and Oklahoma City, the Internal Revenue Service has provided tax relief to individuals and businesses affected by this and other severe storms

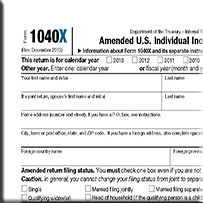

Tax Tips – Filing an Amended Tax Return

Ten Facts on Filing an Amended Tax Return What should you do if you already filed your federal tax return and then discover a mistake? Don’t worry; you have a chance to fix errors by filing an amended tax return.

IRS Gives Boston Taxpayers 3-Month Extension

TACCT extends our thoughts and prayers to all who have been affected by the events that occurred at the Boston Marathon. The Internal Revenue Service granted a three-month tax filing and payment extension to Boston-area taxpayers and others affected by

Tax Tips – Eight Facts on Late Filing and Penalties

April 15 is the annual deadline for most people to file their federal income tax return and pay any taxes they owe. By law, the IRS may assess penalties to taxpayers for both failing to file a tax return and

IRS Payment Options

Ten Helpful Tips for Paying Your Taxes Do you owe the IRS this year? If so, here are 10 important things the IRS wants you to know about correctly paying your federal income taxes. Never send cash. If you file

April 15 Tax Tasks

You know Monday, April 15, is tax day. The big job you must complete by this deadline is finishing and filing your 2012 tax return or Form 4868, which will give you an extension until Oct. 15 to file your