If you are self-employed or have other third-quarter income that requires you to pay quarterly estimated taxes, make sure your third quarter payment is postmarked by Sept. 16, 2014. What are the filing dates for federal quarterly estimated tax payments?

Category: Taxes

Back-to-School Sales Tax Holidays

Some call state sales-tax holidays gimmicks that rely on bad tax policy and cost states much-needed money. Others say the tax-free shopping days boost local economies by getting more people into stores where their purchases might go beyond untaxed goods. But

Top Ten Facts for Selling Your Home

Do you know that if you sell your home and make a profit, the gain may not be taxable? That’s just one key tax rule that you should know. Here are ten facts to keep in mind if you sell

Five Tips for New Business Owners

One key to success in starting a new business is to know about your federal tax obligations such as income taxes and payroll taxes. Below are five basic tax tips that can help get your business off to a good

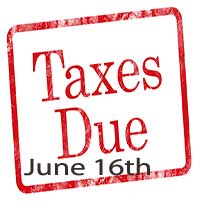

2nd Quarter 2014 Estimated Taxes Due June 16

Tips on Making Estimated Tax Payments If you don’t have taxes withheld from your pay, or you don’t have enough tax withheld, then you may need to make estimated tax payments. If you’re self-employed you normally have to pay your

2014 Small Business Week

Do you own or run a business? If so, do you know the IRS offers special tax help just for you? For example, the IRS will host two free live webinars to mark National Small Business Week, May 12 –

May 15th Filing Deadline for Exempt Organizations

The IRS has a few important reminders as the May 15 filing deadline for many tax-exempt organizations fast approaches. Make sure you file Form 990 if you are required to file. Filing the form is very important for many groups

2015 HSA Deduction Limits

The Internal Revenue Service (IRS) has released the 2015 inflation-adjusted deduction limitations for annual contributions to a Health Savings Account (HSA) which are updated annually to reflect cost-of-living adjustments. In Revenue Procedure 2014-30, the IRS said that for calendar year 2015, the

IRS Scam Warning

IRS Reiterates Warning of Pervasive Telephone Scam WASHINGTON — As the 2014 filing season nears an end, the Internal Revenue Service today issued another strong warning for consumers to guard against sophisticated and aggressive phone scams targeting taxpayers, including recent

Tax Recordkeeping Tips

Resources Recordkeeping for Tax Purposes Guide (pdf) Small Business Recordkeeping Publication 583, Starting a Business and Keeping Records Basic records are documents that everybody should keep. Although the Internal Revenue Service (IRS) doesn’t require you to keep your records in