Tax Return Due Dates for Business Types Taxpayers should be aware of the following dates and deadlines that pertain to their business.

Category: Business

2018 Tax Reform – Tax Law Changes

On December 22, 2017 the President signed into law H.R. 1 (officially titled ‘An Act to Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018’). The legislation was originally

3rd Quarter Estimated Tax Payment

Your quarterly estimated tax payment is due soon. Third Quarter 2017 taxes due by September 15, 2017. Estimated tax is used to pay income tax and self-employment tax, as well as other taxes and amounts reported on your tax return. If

Tax Tips – Uber, Lyft, and Other Ride-Share Drivers

Ride-Sharing Services Instead of sitting at home watching TV reruns during their down time, some of people are making extra cash by offering their services in the shared economy. One of the most popular methods is to become a driver for

March 15 Filing Deadline for Partnerships and S Corp Returns

The filing deadline for calendar year partnerships and S corporations is March 15, 2017. These returns must be filed (e-filed or postmarked) by midnight (local time) on March 15, 2017. Fiscal year returns will be due the 15th day of the

February Challenge – Tax Filing Time!

Get Your Taxes Done in 3 Simple Steps We all know filing taxes isn’t fun for most of us. That’s why TACCT Taxes is here to provide your tax preparation needs. It’s not complicated to get prepared for your tax

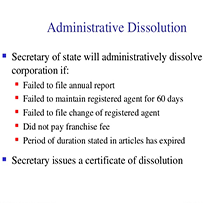

SOS to Dissolve Qualified Inactive California Nonprofit Corporations

Nonprofit Administrative Dissolution Beginning January 2017, we will move forward to administratively dissolve qualified inactive nonprofit corporations. Assembly Bill 557 (Stats. 2015, ch. 363), which becomes effective January 1, 2017, provides for the administrative dissolution of qualified inactive nonprofit corporations.

Tax Documents You’ll Need to File Your Tax Return

Tax Documents Due Date By law, employers have until January 31st (or the next business day if it’s a weekend or holiday) to send you their annual tax statements such as W2s, 1099-INT etc. Many taxpayers have opted to receive

Self-Employed Tax Tips

Tax Tips for the Self-Employed Prior to tax planning, you must understand the difference between a self-employed individual and one who works full-time. You should also know that self-employed professionals do not get taxes deducted from their pay.

2017 Mileage Rates Lowered by IRS

The Internal Revenue Service has issued the 2017 optional standard mileage rates to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Beginning Jan. 1, standard mileage rates for the use of a car