Tips on Making Estimated Tax Payments

If you don’t have taxes withheld from your pay, or you don’t have enough tax withheld, then you may need to make estimated tax payments. If you’re self-employed you normally have to pay your taxes this way.

Here are six tips you should know about estimated taxes:

- You should pay estimated taxes in 2014 if you expect to owe $1,000 or more when you file your federal tax return. Special rules apply to farmers and fishermen.

- Estimate the amount of income you expect to receive for the year to determine the amount of taxes you may owe. Make sure that you take into account any tax deductions and credits that you will be eligible to claim. Life changes during the year, such as a change in marital status or the birth of a child, can affect your taxes.

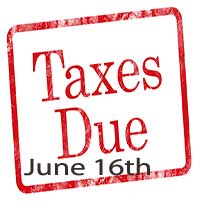

- You normally make estimated tax payments four times a year. The dates that apply to most people are April 15, June 16 and Sept. 15 in 2014, and Jan. 15, 2015.

If you are self-employed or have other second-quarter income that requires you to pay quarterly estimated taxes, make sure your payment is postmarked by June 16, 2014.

- You may pay online or by phone. You may also pay by check or money order, or by credit or debit card. If you mail your payments to the IRS, use the payment vouchers that come with Form 1040-ES, Estimated Tax for Individuals.

- Check out the electronic payment options on IRS.gov. The Electronic Filing Tax Payment System is a free and easy way to make your payments electronically.

- Use Form 1040-ES and its instructions to figure your estimated taxes.

Additional Resources:

- Publication 505, Tax Withholding and Estimated Tax

- Estimated Tax – frequently asked Q & As

- Tax Topic 306 – Penalty for Underpayment of Estimated Tax

- Publications and Forms for the Self Employed