Tax Reform 101

The Tax Cuts and Jobs Act of 2017 officially starts affecting tax returns Jan 1, 2018, so your taxes next January will look a bit (or a lot) different. Let’s walk through some of the most significant changes to the tax law, so you know what to expect.

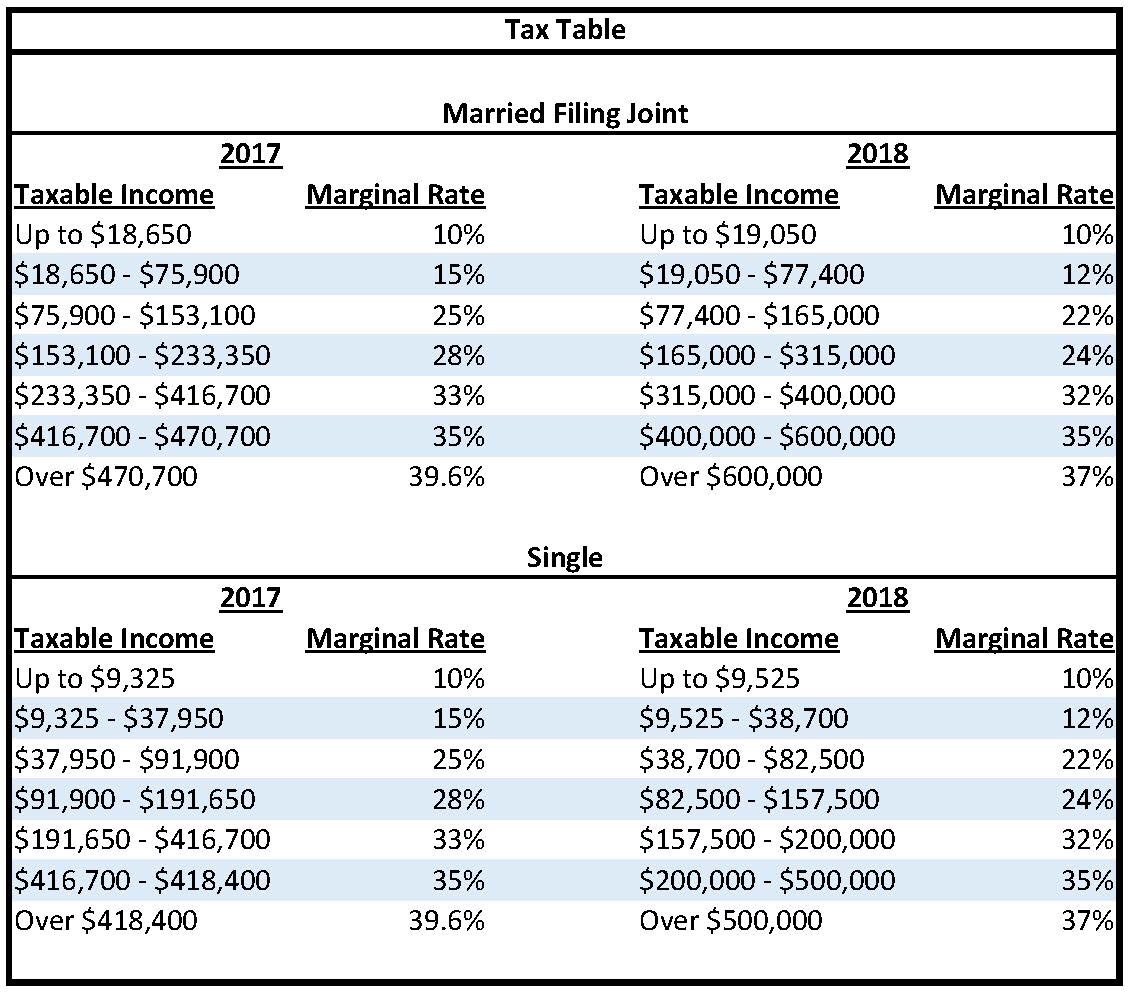

Tax Brackets

The tax brackets were changed. The tax rate for the 10% bracket and the 35% stayed the same, but the income amounts for both were raised. A raised income amount in a tax bracket means that you can earn more money before moving up to a higher tax rate.

In the other 5 brackets, the tax rate was lowered, and the income amounts were adjusted. In general, it means more income will be taxed at lower rates, so virtually everyone will be subject to lower taxes in 2018. You can compare and contrast tax brackets in the tables below.

New Standard Deduction Amounts and the Personal Exemption

Until the new tax bill, you would get a personal exemption for yourself, your spouse and each dependent in your household. The personal exemption amount, $4,050 per person in 2017, would reduce your taxable income. The personal exemption has been repealed in favor of raising the standard deduction, which also reduces your taxable income but only applies to each filer, not each person in the household.

Taxpayers can still itemize deductions, but many won’t have enough individual deductions to merit itemizing. This is also because all itemized deductions have been repealed except state and local income taxes (capped at $10,000), mortgage interest, medical expenses, disaster losses (attributable to a federally declared disaster), charitable contributions (up to 60% of income), and other deductions not subject to the 2% floor. Deductions for unreimbursed employee expenses, tax preparation fees and safety deposit boxes have been eliminated.

Here are the new standard deduction amounts for each filing status:

Child Tax Credit

Taxpayers with kids, or any qualifying dependents, will get a boost from the new Child Tax Credit (CTC) rates. The credit amount per child is doubling from $1,000 to $2,000, and $1,400 of that amount will be refundable (meaning that, if your tax liability is reduced to zero, you could still get up to $1,400 in refund money).

But there are phaseouts for the Child Tax Credit: married taxpayers filing jointly with an AGI greater than $400,000 and all other taxpayers with an AGI greater than $200,000 will not qualify for the credit.

Non-child Dependent Credit

The TCJA allows a new $500 nonrefundable credit for dependents who do not qualify for the child tax credit. Taxpayers can claim this credit for children who are too old for the child tax credit, as well as for non-child dependents. There is no SSN requirement to claim this credit, so taxpayers can claim the credit for children with an Individual Tax Identification Number (ITIN) or an Adoption Tax Identification Number (ATIN) if they otherwise qualify.

Taxpayers cannot claim the credit for themselves or their spouse (if MFJ).

In 2026, the credit for non-child dependents will no longer be available.

Affordable Care Act

The penalty on individuals for failing to maintain minimum essential health coverage was repealed, but does not take effect until 2019. The penalty, or shared responsibility payment, still applies for 2018.

The penalty for failure to obtain health insurance coverage (the “individual mandate”) will be eliminated beginning in 2019. Taxpayers who did not have coverage in 2017 or 2018 will continue to owe a penalty for those years, unless they qualify for an exemption.

Education

Taxpayers can continue to claim the American Opportunity Credit, a credit of up to $2,500 per year for the first four years of college education, and the lifetime learning credit, a credit of up to $2,000 per year for qualifying education expenses.

Taxpayers can continue to use savings bonds for education, educational assistance programs provided by employers, 529 plans and Coverdell education savings plans to save for college. Some scholarships and tuition waivers can continue to be treated as tax-free if certain conditions are met.

529 plans

The new distribution limitation of $10,000 now applies on a per-student basis instead of a per-account basis. These distributions can now be used for (K-12) public, private, or religious education in elementary or secondary schools, and can also be used for homeschool-related expenses.

Qualifying expenses include:

- Curricular courses and materials

- Books or other instructional materials

- Online educational materials

- Tutoring or educational classes outside of the home (provided the instructor is not a relative of the student)

- Dual enrollment in an institution of higher education

- Educational therapies for students with disabilities

Itemized Deductions

Before the tax reform bill takes effect, about 40% of taxpayers itemized deductions on Schedule A, instead of taking the standard deduction associated with their filing status. However, the TCJA has a large impact on itemized deductions, as several itemized deductions have been eliminated, limited, or modified. These tax reforms are only for Federal filings unless the State confirms to them as well (California does not confirm, so you can still use some of the deductions on your state tax return).

Fully eliminated

- Miscellaneous itemized deductions subject to the 2-percent floor

- Employee business expenses (some are listed below)

-

-

- Subscribing to a trade magazine

-

- Attending an industry conference

-

- Buying protective clothing

-

- Paying union dues

-

- Buying your own tools

-

- Driving your vehicle

-

- Paying for travel, lodging, and meals

-

- Working with an employment agency to find a new job

-

- Using any part of your home for your work

- Tax preparation fees

- Investment interest expenses

-

- Personal casualty and theft losses (except for certain losses in certain federally declared disaster areas)

- The overall limit on itemized deductions (often called the Pease limit)

Limited

- State and local income taxes (SALT) or state and local sales tax, plus real property taxes, may be deducted, but only up to a combined total limit of $10,000 ($5,000 if MFS)

- Home mortgage interest has several modifications:

- Interest on a home equity loan is no longer deductible if it’s not to build, repair, or buy the home.

- Interest on a new home mortgage is limited to interest paid on a maximum of $750,000 ($350,000 if MFS) on a new mortgage taken out after December 14, 2017.

- Taxpayers with a mortgage that started before December 15, 2017 can continue to claim home mortgage interest on up to $1 million ($500,000 if MFS) going forward; the $1 million ($500,000 if MFS) limit continues to apply to a refinanced mortgage incurred before December 15, 2017.

Modified

- Charitable contributions: The deduction for charitable contributions is expanded so that taxpayers may contribute up to 60% of their adjusted gross income, rather than up to 50%.

- Gambling losses remain deductible, but only to the extent of gambling winnings. The definition of losses from wagering transactions is modified.

- Medical expenses remain deductible. Through tax year 2018, medical expenses are deductible to the extent they exceed 7.5% of AGI. In 2019, that number will increase to 10% of AGI.

Most of the changes to itemized deductions will remain in place through 2025.

“Above-the-line” Deductions

As with itemized deductions, many “above-the-line” adjustments have also been eliminated or limited:

Fully eliminated

- Alimony payments will not be deductible to the payor or taxable to the recipient beginning with new divorces in 2019. (Payments under existing orders are grandfathered and may continue to be deducted by the payor and should be reported as income by the recipient.)

- Tuition and fees deduction expired under previous law and was not renewed by the TCJA.

- Domestic production activities deduction (DPAD)

Mostly eliminated

- Moving expenses are disallowed unless you are an active duty member of the Armed Forces who moves due to military orders.

Stays the same

- Educator expense deduction (K-12 educators can deduct up to $250 per year for unreimbursed classroom supplies.)

- Student loan interest of up to $2,500 can be deducted by qualifying taxpayers for interest paid on student loans.

- Health savings account (HSA) deduction

- IRA deduction

- Deductions for self-employed taxpayers (SE tax, SE health insurance, SE qualified retirement plan contributions)

Business Deductions

The new tax reform law includes a bunch of other changes affecting deductions and credits commonly claimed by businesses. For instance:

- Revamps the rules for net operating losses (NOLs). Essentially, NOLs can no longer be carried back for two years, but can now be carried forward indefinitely (instead of for 20 years), subject to a limit of 80& of taxable income.

- The deduction for entertainment expenses that are directly-related-to or associated-with the conduct of business are repealed.

- The deduction for transportation fringe benefits – including mass transit passes, commuter vehicles and parking privileges – are repealed. If employers still provide these benefits, they remain tax-free to employees.

- The deduction for business interest expenses is generally capped at 30% of adjusted taxable income, among other requirements. However, a small business with annual average gross receipts of $25 million or less for the past three years is exempt from this rule.

Corporate Taxation

The graduated tax rate structure for corporations, featuring a top tax rate of 35%, is being replaced by a flat rate of 21%. As a result, the overall tax liability of many C corporations will be reduced. Furthermore, cash accounting was generally not available to corporations with average gross receipts for the three prior years of $5 million or more. This rule has been replaced by a $25 million gross receipts test.

Section 179 Deductions

Under Section 179 of the Internal Revenue Code, a business could expense up to $500,000 of the cost of qualified business property, subject to a dollar-for-dollar phaseout above $2 million. These figures were indexed for inflation. The new doubles the maximum allowance to $1 million and increases the phaseout threshold to $2.5 million. Caveat: The maximum allowance is still limited to the amount of income from business activity.

Vehicle Depreciation

The new vehicle depreciation limits (which only apply to vehicles placed in service after December 31, 2017) are higher and take inflation amounts into consideration. Vehicles for which additional first-year depreciation was claimed do not qualify for these depreciation amounts.

- 1st year: $10,000

- 2nd year: $16,000

- 3rd year: $9,600

- Each following year until cost is fully recovered: $5,760

Qualified Business Income (QBI) 20% deduction

Self-employed taxpayers can deduct up to 20% of qualified business income from a sole proprietorship, partnership, or S corporation. There are a few limitations placed on the deductions, but many small businesses will be able to benefit.

Example: A self-employed taxpayer has taxable income of $60,000. All of the income is from the business. The qualified business income deduction is $12,000 ($60,000 × 20%).

Since corporations got a significant tax rate reduction, Congress needed to provide some form of tax break for the other business types where income tax is calculated and reported on individual tax returns (1040s).

Enter the QBI deduction for individuals who have partnership, S corporation, LLC, or sole proprietorship income—which includes the millions of freelancers and contractors out there working for themselves and filing a Schedule C to report income on their tax return. The QBI deduction is worth 20% of your “qualified business income” (essentially your net profit), and it reduces your taxable income.

You don’t have to itemize your deductions in order to claim the QBI deduction, but the business must be conducted in the U.S.

For pass-through entities, such as partnerships and S corporations, the deduction has some extra limitations. Your total deduction amount cannot exceed the greater of:

- 50% of the W-2 wages paid, or

- 25% of the W-2 wages paid, plus 2.5% of the unadjusted basis of all tangible, depreciable trade or business property that is:

- Available for use at the close of the tax year

- Used at any point during the tax year in the production of qualified business income

- Still depreciable before the close of the tax year

The QBI deduction phases out for businesses defined as a Specified Service Trade or Business (SSTB). An SSTB is any business activity where the revenue is generated from a specialized skill or service (health, law, medicine, etc.). Their QBI phases out at $315,000 for joint filers, $207,500 for head of household filers, and $157,500 for single filers.

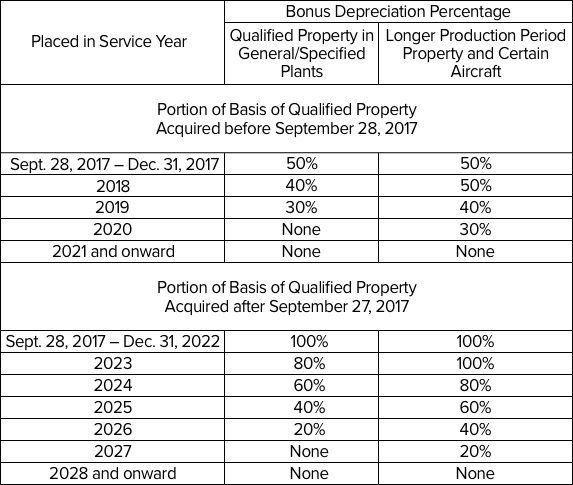

Bonus Depreciation

Additional first year depreciation is now available on used property. Prior to the new law, only new property qualified.

Talk to a Tax Professional!

It is highly recommended to speak with a tax professional about detailed changes to your particular tax situation and how you can plan for your taxes for the upcoming season. Please contact TACCT Taxes to schedule a consultation.